40 find coupon rate of bond

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated by dividing Annual Coupon Payment by Face Value of Bond, the result is expressed in percentage form. The formula for Coupon Rate - Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Below are the steps to calculate the Coupon Rate of a bond: Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

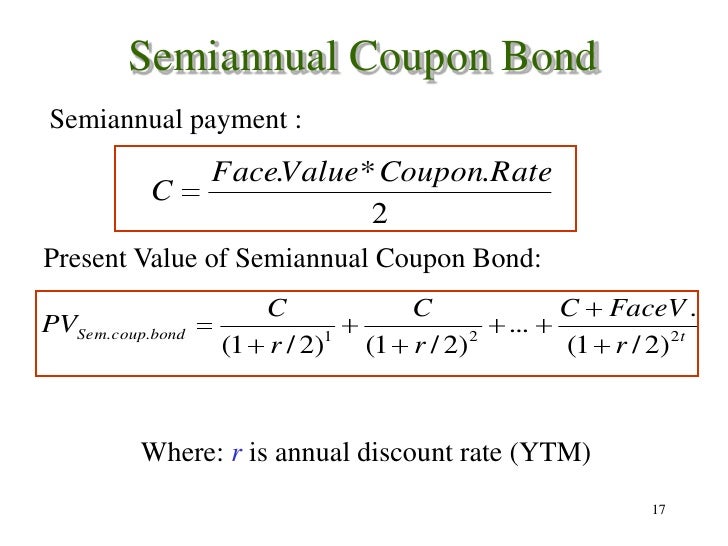

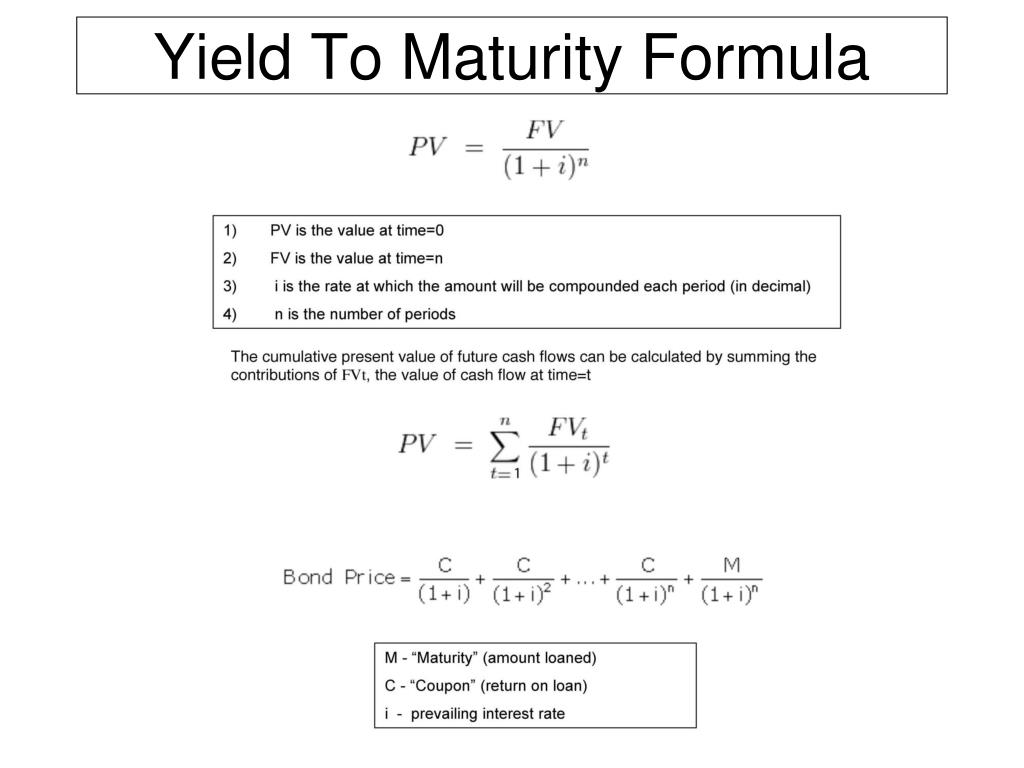

Coupon Bond - Guide, Examples, How Coupon Bonds Work c = Coupon rate i = Interest rate n = number of payments Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources Thank you for reading CFI's guide on Coupon Bond.

Find coupon rate of bond

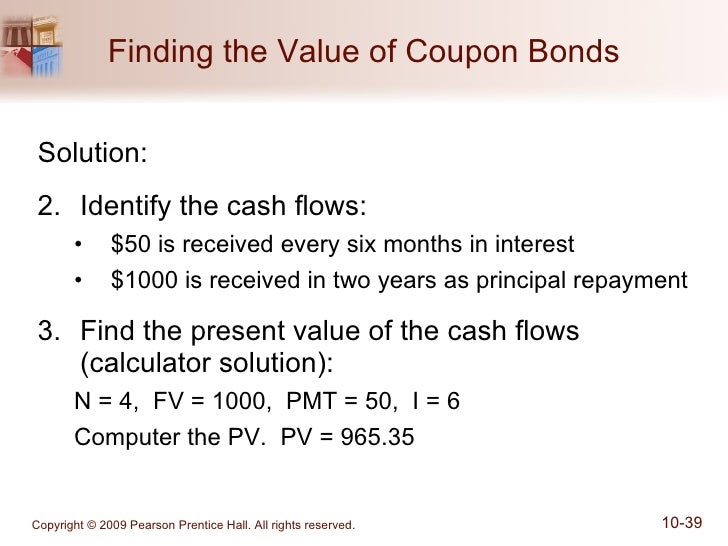

Coupon Rate Calculator | Bond Coupon 15.07.2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... Create function in R to find coupon rate for bond Create function in R to find coupon rate for bond. c_rate <- function (bond_value, par, ttm, y) { t <- seq (1, ttm, 1) pv_factor <- 1 / (1 + y)^t cr <- (bond_value - par / (1+y)^t) / (par*sum (pv_factor)) cr } however, this yields multiple results. How can i update the function to only yield one the final index only? In the final line. What is a Coupon Rate? - Definition | Meaning | Example In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example. The coupon payment on each bond is $1,000 x 8% = $80. So, Georgia will receive $80 interest payment as a bondholder.

Find coupon rate of bond. Should You Redeem Your Savings Bond? Use This Calculator to Find … 03.07.2020 · Series EE savings bonds have a fixed interest rate (Series EE bonds issued before May 2005 may have a variable rate). Starting with a $25 bond, you can buy up to $10,000 per year online at TreasuryDirect.gov. Interest gets added to the bond monthly, and the government guarantees that the bond will double in value after 20 years. After 30 years ... Fixed Rate Bonds | Nationwide Fixed Rate Bond Key Product Information. PDF, 75KB (opens in a new window) Our Savings General Terms and Conditions. PDF, 122KB (opens in a new window) Other Important Information. Charitable assignment. Declaration. Withdrawal limits. Savings and ISA help. Useful guides to help you manage your account and understand the different ways to save. Savings … Bond derivatives - Australian Securities Exchange For each bond in the bond basket, ASX will take the best bid and best offer available in the market by reference to live market prices taken from bond trading venues as determined by the Exchange. The average of the best bid and best offer for each bond will be calculated at 9:00am, 9:45am, 10:30am and 11:15am. Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50. With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture. Let's say that, after five years, you decided to sell the ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Longer duration bonds are more sensitive to shifts in interest rates. And zero-coupon long duration bonds are more sensitive to rate shifts than bonds which regularly pay interest. Typically the yield curve is upward sloping with longer duration bonds offering a higher return to compensate for the added risk. When shorter duration bonds offer a ... How can I calculate a bond's coupon rate in Excel? How to Find the Coupon Rate. In Excel, enter the coupon fee in cell A1. In cell A2, enter the variety of coupon funds you obtain annually. If the bond pays curiosity as soon as a yr, enter 1. If you obtain funds semi-annually, enter 2. Enter four for a bond that pays quarterly. In cell A3, enter the method =A1x A2 to yield the entire annual ... › bond-basics-417057Bond Basics: Issue Size and Date, Maturity Value, Coupon May 28, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. Yield to Maturity vs. Coupon Rate: What's the Difference? 20.05.2022 · The coupon rate is the annual amount of interest that the owner of the bond will receive. To complicate things the coupon rate may also …

How to Calculate Bond Discount Rate: 14 Steps (with Pictures) - wikiHow For this calculation, you need to know the bond's annual coupon rate and the annual market interest rate. Also, find out the number of interest payments per year and the total number of coupon payments. Using the example above, the annual coupon rate is 10 percent and the annual current market interest rate is 12 percent. Coupon Rate - Meaning, Calculation and Importance - Scripbox Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure. Coupon Rate = (Total Annual Interest Payments / Face Value of the Bond) * 100 Let's understand couponrate calculation with the help of an example. How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a... What Is the Coupon Rate of a Bond? - The Balance 18.11.2021 · The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bondholders will receive $30 in interest payments each year, generally paid on a semiannual basis.

› blog › savings-bond-calculatorShould You Redeem Your Savings Bond? Use This ... - Quicken Jul 03, 2020 · Series EE savings bonds have a fixed interest rate (Series EE bonds issued before May 2005 may have a variable rate). Starting with a $25 bond, you can buy up to $10,000 per year online at TreasuryDirect.gov. Interest gets added to the bond monthly, and the government guarantees that the bond will double in value after 20 years. After 30 years ...

› what-is-the-coupon-rate-of-aWhat Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bondholders will receive $30 in interest payments each year, generally paid on a semiannual basis.

Bond Price Calculator - Belonging Wealth Management A bond's coupon is the interest payment you receive. Use the simple annual coupon payment in the calculator. If your bond has a face, or maturity, value of $1,000 and a coupon rate of 6% then input $60 in the coupon field. Compounding Frequency. For most bonds, this is semi-annual to coincide with the fact that you receive two annual coupon ...

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment is .08 * 1000 or $80. [6] 2

What Is a Coupon Rate? How To Calculate Them & What They're Used For Coupon rates can be determined by dividing the sum of the annual coupon payments by the actual bond's face value. However, this is not the same as the interest rate. For instance, a bond with a face value of $5,000 and a coupon of 10%, pays $500 every year.

Compare Fixed Rate Bonds | MoneySuperMarket Some fixed rate bond accounts can be opened with as little as £1, for example, but typical minimum deposits start at about £500. Maximum deposits can go into millions, but remember only the first £85,000 will be protected by the FSCS (where applicable). You may find the most competitive rates require a larger deposit – although, this isn’t always the case. Once you’ve …

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

How to Find Coupon Rate of a Bond on Financial Calculator To calculate the coupon rate on a financial calculator, enter the face value of the bond and then press the 'Coupon' or 'CP' button. This will bring up a list of different coupon rates. Find the coupon rate that matches the interest rate on your bond and press enter. The COUP function will then calculate the coupon rate for you. Formula: C=PZ ^ k

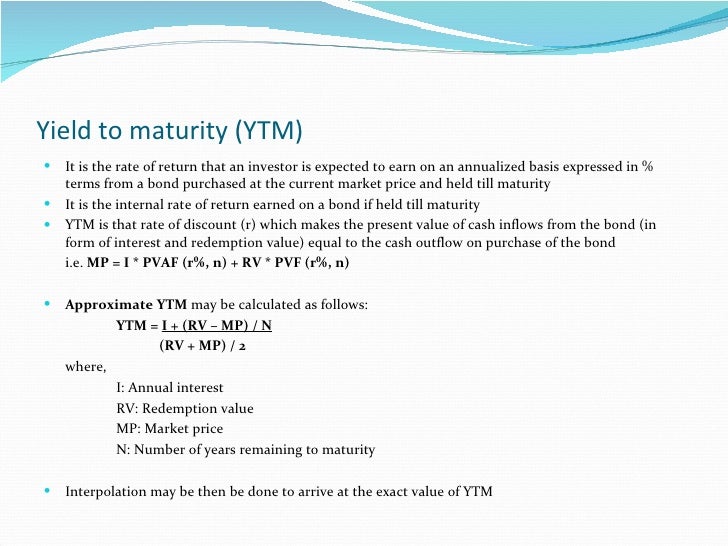

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing When calculating the yield-to-maturity, you take into account the coupon rate and any increase or decrease in the price of the bond. For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals $20. Whether the economy improves, worsens, or remains the same, the interest income does not change.

› Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73.

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

Bonds Calculate Coupon Rate - YouTube how to calculate coupon rate on a bondexamples using excel and financial calculator

What is a Coupon Rate? | Bond Investing | Investment U Calculating a bond's coupon rate comes down to examining its par value and its yield. Specifically, investors would divide the sum of annual interest payments by the par value: Coupon Rate = Total Coupon Payments / Par Value For example, if a company issues a $1,000 bond with two $25 semi-annual payments, its coupon rate would be $50/$1000 = 5%.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay ...

Bond Price Calculator c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules:

Bond Value Calculator: What It Should Be Trading At | Shows Work! Enter the par (face) value of the bond. Step #2: Enter the bond's coupon rate percentage. Step #3: Select the coupon rate compounding interval. Step #4: Enter the current market rate that a similar bond is selling for. Step #5: Enter the number of years until the bond reaches maturity. Step #6: Click the "Calculate Bond Price" button.

Post a Comment for "40 find coupon rate of bond"