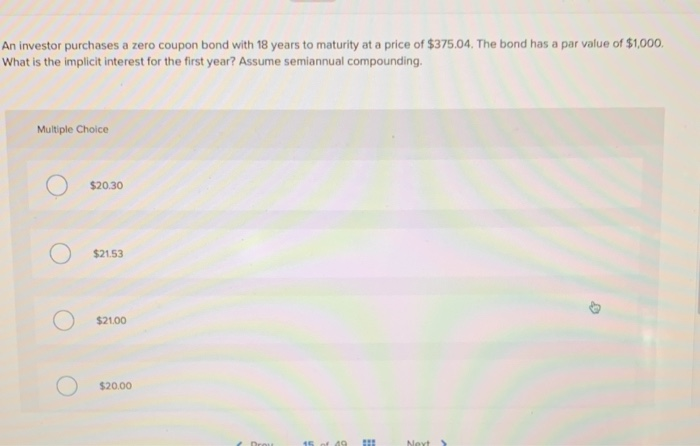

40 valuing zero coupon bonds

ACCT 223 | Chapter 7 Flashcards | Quizlet 2. Characteristics of Bonds a. A bond's _____ is generally $1,000 and represents the amount borrowed from the bond's first purchaser. b. A bond issuer is said to be in _____ if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants. All the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor.

All the 21 Types of Bonds | General Features and Valuation | eFM 13.06.2022 · Different Types of Bonds Plain Vanilla Bonds. A plain vanilla bond is a bond without unusual features; it is one of the simplest forms of bond with a fixed coupon and a defined maturity and is usually issued and redeemed at face value. It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon …

Valuing zero coupon bonds

ACCT 223 | Chapter 7 Flashcards | Quizlet 2. Characteristics of Bonds a. A bond's _____ is generally $1,000 and represents the amount borrowed from the bond's first purchaser. b. A bond issuer is said to be in _____ if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants. Answered: Your Aunt Betty has a $120,000… | bartleby Assume you are treasury manager in a company and the company requires $1,000,000 ($1 Million) in 6 months for the duration of 1 year. You can finance this need by trading zero-coupon bonds, i.e., buying or selling zero-coupon bonds or go to bank to organize a forward contract. The bank quotes a forward rate 14% per annum semi-annual compounding ... Swaps in Finance | Definition | Examples | Valuation Types of Swaps in Finance. There are several types of Swaps transacted in the financial world. They are a commodity, currency, volatility, debt, credit default, puttable, swaptions, Interest rate swap, equity swap Equity Swap Equity Swaps is defined as a derivative contract between two parties that involve the exchange of future cash flows. There are two basis of determining cash …

Valuing zero coupon bonds. Chapter 12: The Cost of Capital - California State University ... Title: Chapter 12: The Cost of Capital Subject: Gallagher and Andrew Author: Gallagher Last modified by: kuhlejl Created Date: 6/19/1997 4:16:34 PM 75.40 - General Ledger Account Codes - Washington 5260 - LONG-TERM BONDS PAYABLE. 5261. General Obligation (GO) Bonds Payable . 5262. Revenue Bonds Payable . 5263. Limited Obligation Bonds Payable . 5264. Zero-Coupon GO Rate Bonds Payable . 5267: General Revenue Bonds Payable – Internal Lending (UW Only) 5269. Other Bonds Payable : 5270 - LONG-TERM INSTALLMENTS AND LEASES PAYABLE. 5271 Net Asset Value (NAV): Formula and NAV Per Share Calculation Ultimate Guide to Debt & Leveraged Finance Senior Debt Subordinated Debt Bank Debt vs. Corporate Bonds Corporate Banking Financing Bonds Payable Mezzanine Financing Covenant-Lite Loans Syndicated Loan Bridge Loans Zero-Coupon Bond Convertible Bonds Unitranche Debt High Yield Bonds (HYBs) What are bond spreads? - Financial Pipeline 19.02.2016 · For example, an investor can buy Province of Ontario “zero coupon” bonds for the same maturity date in three different forms: 1) a “coupon” which is a stripped coupon payment from an Ontario bond; 2) a “residual” which is the stripped principal payment from an Ontario bond; and 3) an actual zero-coupon Ontario Global bond issue which was originally issued as …

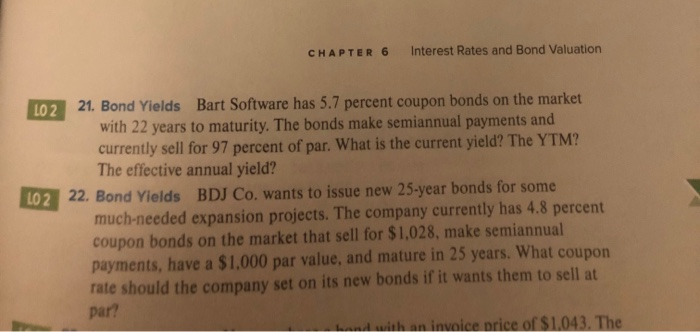

SOPHIA PATHWAYS Principles of Finance unit 2 - Quizlet b.)Longer-term bonds are less sensitive to interest rate risk than shorter-term bonds. c.)Bonds held until maturity have greater exposure to interest rate risk. d.)It stems from the fact that coupon rates and market interest rates are directly correlated. Fundamentals of Finance | Coursera From valuing claims and making financing decisions, to elements of a basic financial model, the coursework provides a solid foundation to corporate finance. The specialization then moves to financial accounting, enabling learners to read financial statements and to understand the language and grammar of accounting. Fundamentals of Finance | Coursera Holding Period Return and Yield to Maturity for Zero-Coupon Bonds 10m. Calculating the Holding Period Return on a Coupon Bond 10m. Topic 3 Lecture Slides 10m. Topic 3 Lecture Notes 10m. 1 practice exercise. Module 2 Quiz 30m. Week. 3. Week 3. 2 hours to complete. Module 3 - Equity Valuation. In this module, you’ll examine how to determine the value of … Chapter 7 -- Stocks and Stock Valuation - California State … Valuing a corporation Preferred stock The efficient market hypothesis (EMH) Characteristics of common stock Ownership in a corporation: control of the firm Claim on income: residual claim on income Claim on assets: residual claim on assets Commonly used terms: voting rights, proxy, proxy fight, takeover, preemptive rights, classified stock, and limited liability The market price …

What are bond spreads? - Financial Pipeline Feb 19, 2016 · The yield spread or “curve spread ” between these two bonds is 1.6%, which reflects the interest rate between the two bonds and the conditions of monetary policy. Coupon Spreads are spreads that reflect the differences between bonds with different interest rate coupons. For example, the Government of Canada has issued two bonds that are due ... Chapter 12: The Cost of Capital - California State University, … Title: Chapter 12: The Cost of Capital Subject: Gallagher and Andrew Author: Gallagher Last modified by: kuhlejl Created Date: 6/19/1997 4:16:34 PM Reserve Bank of India - Frequently Asked Questions STRIPS in G-Secs ensure availability of sovereign zero coupon bonds, which facilitate the development of a market determined zero coupon yield curve (ZCYC). STRIPS also provide institutional investors with an additional instrument for their asset liability management (ALM). Further, as STRIPS have zero reinvestment risk, being zero coupon bonds, they can be … Swaps in Finance | Definition | Examples | Valuation Types of Swaps in Finance. There are several types of Swaps transacted in the financial world. They are a commodity, currency, volatility, debt, credit default, puttable, swaptions, Interest rate swap, equity swap Equity Swap Equity Swaps is defined as a derivative contract between two parties that involve the exchange of future cash flows. There are two basis of determining cash …

Answered: Your Aunt Betty has a $120,000… | bartleby Assume you are treasury manager in a company and the company requires $1,000,000 ($1 Million) in 6 months for the duration of 1 year. You can finance this need by trading zero-coupon bonds, i.e., buying or selling zero-coupon bonds or go to bank to organize a forward contract. The bank quotes a forward rate 14% per annum semi-annual compounding ...

ACCT 223 | Chapter 7 Flashcards | Quizlet 2. Characteristics of Bonds a. A bond's _____ is generally $1,000 and represents the amount borrowed from the bond's first purchaser. b. A bond issuer is said to be in _____ if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants.

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...](https://www.researchgate.net/profile/Kourosh-Marjani-Rasmussen-2/publication/265866672/figure/fig4/AS:669401900666891@1536609258367/Yield-curves-for-Danish-zero-coupon-bonds-The-red-curve-is-a-normal-shaped-yield-curve_Q640.jpg)

Post a Comment for "40 valuing zero coupon bonds"