42 10 year treasury bond coupon rate

Coupon Rate of a Bond - WallStreetMojo Annual interest payment = Periodic interest payment * No. of payments in a year. Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100%, as shown below. How Is the Interest Rate on a Treasury Bond Determined? - Investopedia This is known as the coupon rate. 2 For example, a $10,000 T-bond with a 5% coupon will pay out $500 annually, regardless of what price the bond is trading for in the market. This is where...

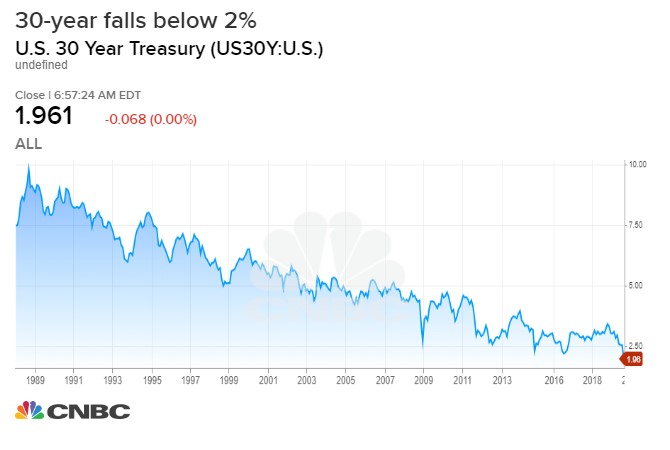

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)...

10 year treasury bond coupon rate

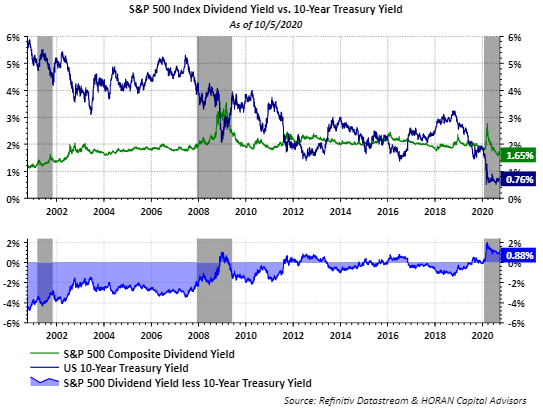

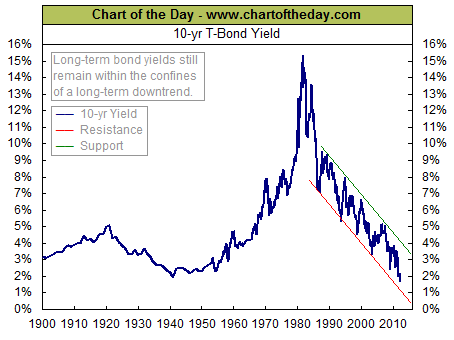

Coupon Interest and Yield for eTBs | australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. TMUBMUSD10Y | U.S. 10 Year Treasury Note Price & News - WSJ TMUBMUSD10Y | View the latest U.S. 10 Year Treasury Note news, historical stock charts, analyst ratings, financials, and today's stock price from WSJ. 10 Year Treasury Rate - YCharts Sep 06, 2022 · The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury ...

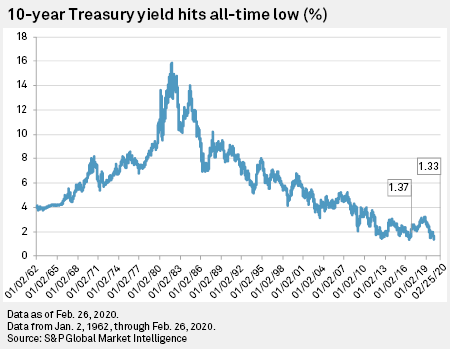

10 year treasury bond coupon rate. Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Yield Calculation for a 10-Year Treasury Note | Sapling However, if you buy a bond for $900, you'll receive your annual four percent coupon plus an additional $100 at maturity. The formula for the yield to maturity calculation is: Where: P = price of the bond. n = number of periods. C = coupon payment. r = required rate of return on this investment. F = maturity value. 10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of September 08, 2022 is 3.29%. Show Recessions Download Historical Data Export Image

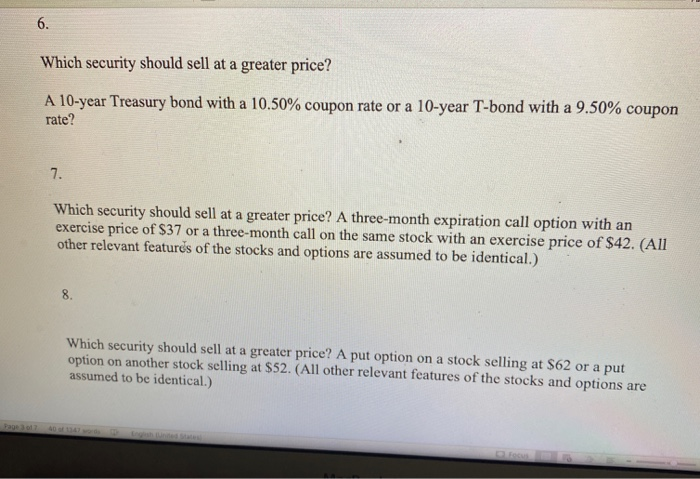

Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present. TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present TNC Treasury Yield Curve Forward Rates, Monthly Average: 1976-Present TNC Treasury Yield Curve On-the-Run Par Yields, Monthly Average: 1986-Present ... 10-Year T-Note Futures Quotes - CME Group Among the most actively watched benchmarks in the world, the 10-Year U.S. Treasury Note futures contract offers unrivaled liquidity and capital-efficient, off-balance sheet Treasury exposure, making it an ideal tool for a variety of hedging and risk management applications, including: interest rate hedging, basis trading, adjusting portfolio duration, curve trading, expressing directional ... Solved The yield of the 10-year US Treasury bond is 1.20%. - Chegg The yield of the 10-year US Treasury bond is 1.20%. It is the risk-free rate. You work for investment manager and your boss asks you to calculate the price of a 10-year corporate bond that yields 3.00% more than its risk-free rate and has a face value of $1,000. The fixed coupon of this corporate bond is 5.00%. Treasury Return Calculator, With Coupon Reinvestment - DQYDJ A 10 Year Treasury note pays a coupon every 6 months. The calculator assumes bonds are bought at face value with no transaction fees and a tax rate of 0%.

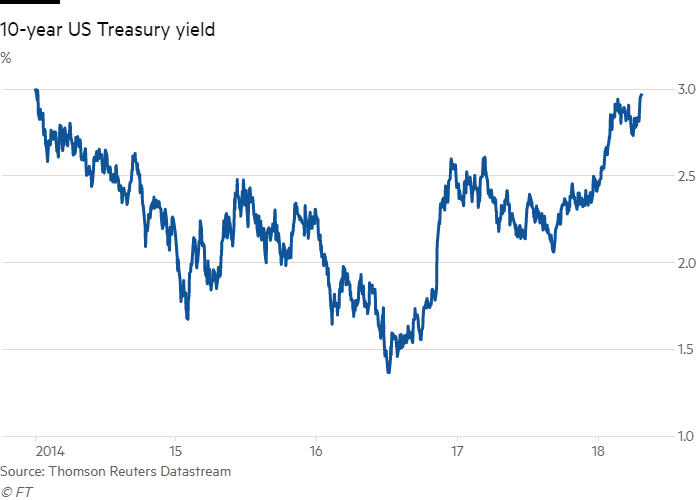

US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months. Treasury Bond (T-Bond) - Overview, Mechanics, Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate. Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-09-02 about 10-year, bonds, yield, interest rate, interest, rate, and USA. ... three-factor arbitrage-free term structure model to U.S. Treasury yields since 1990, in order to evaluate the behavior of long-term yields, distant ... US 10 year Treasury Bond, chart, prices - FT.com A look inside the ECB's climate strategy Sep 12 2022; Will the Fed really sell its mortgage bonds next year? Sep 12 2022; Why BlackRock's climate challenge is harder than it makes out Sep 09 2022; US stocks close higher to end three straight weeks of declines Sep 09 2022; Anti-ESG ETF gets off to a roaring start Sep 09 2022; ECB to start talks on shrinking its balance sheet Sep 09 2022

10-Year Treasury Note Definition - Investopedia The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate once every six months and pays the face valueto the holder at maturity. The U.S. government partially funds itself by issuing 10-year Treasury notes.

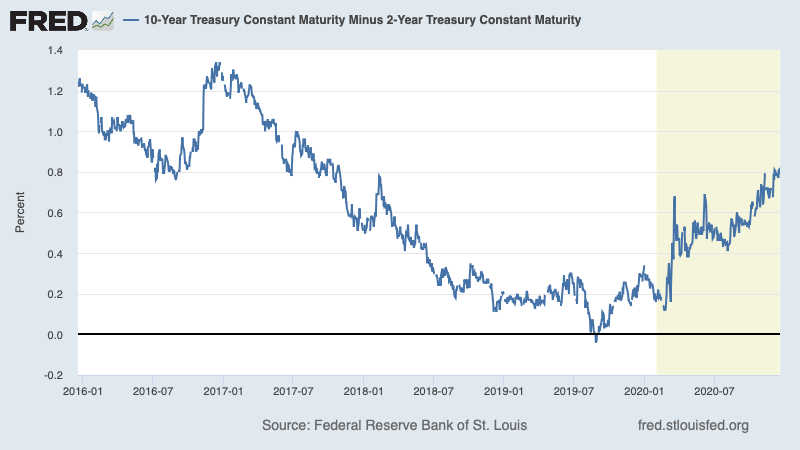

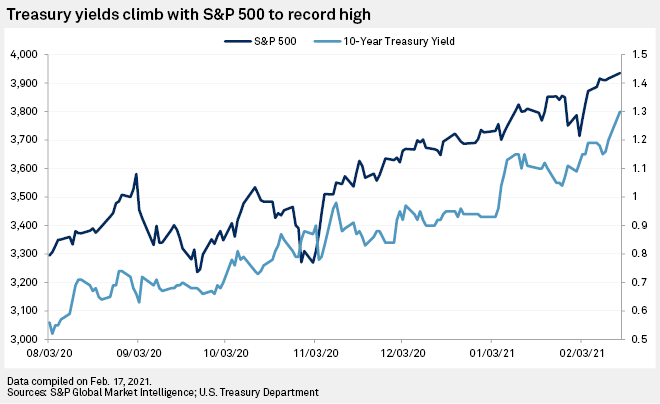

10-Year US Treasury Note - Guide, Examples, Importance of 10-Yr Notes The 10-year US T-note is one of the most tracked treasury yields in the United States. Investors can assess the performance of the economy by looking at the Treasury yield curve. The yield curve is a graphic representation of all yields starting from the one-month T-bill to 30-year T-bond. The 10-year T-note is located in the middle of the ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month . ... Muni Bonds 10 Year Yield . 2.73% +0 +47

TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch 1 day ago · TMUBMUSD10Y | A complete U.S. 10 Year Treasury Note bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates.

Should You Buy Treasuries? - Forbes The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison, Nerdwallet reports the national average rate on a high-yield savings account is .70%. (Note: both figures are annualized, so...

Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .)

What is the Coupon Rate? - Realonomics The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond. ... What is the coupon rate on a 10 year treasury? Treasury Yields. Name Coupon Yield; GT2:GOV 2 Year: 1.50: 1.93%: GT5:GOV 5 Year: 1.88: 2.15%: GT10:GOV 10 Year: 1. ...

US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Yield Open 3.319% Yield Day High 3.331% Yield Day Low 3.291% Yield Prev Close 3.292% Price 95.3125 Price Change -0.125 Price Change % -0.1328% Price Prev Close 95.4375 Price Day High 95.4531 Price...

Gov't raises P45B from10-year treasury bonds | Inquirer Business The government raised a total of P45 billion from an original issue of 10-year treasury bonds, which carried a coupon of 6.75 percent but fetched an average yield of 6.703 percent. At the secondary

10 Year Treasury Rate - YCharts Sep 06, 2022 · The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury ...

TMUBMUSD10Y | U.S. 10 Year Treasury Note Price & News - WSJ TMUBMUSD10Y | View the latest U.S. 10 Year Treasury Note news, historical stock charts, analyst ratings, financials, and today's stock price from WSJ.

Coupon Interest and Yield for eTBs | australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months.

/10-year-treasury-note-3305795-Final-b5449ca2619747788f6366ccebd81ca7.png)

:max_bytes(150000):strip_icc()/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

/GettyImages-484971962-ac89281a1d3e4bb5abe75e88f8df3177.jpg)

Post a Comment for "42 10 year treasury bond coupon rate"