43 perpetual zero coupon bond

Zero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI).. It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon.. It is called Swap because at maturity … Video Games | Consoles, Games, Accessories | GameStop GameStop has a wide variety of Video Games available for you to purchase today. Browse our vast selection of Video Games products.

Bond market - Wikipedia The bond market (also debt market or credit market) is a financial market where participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market.This is usually in the form of bonds, but it may include notes, bills, and so on for public and private expenditures.The bond market has largely been dominated by the United …

Perpetual zero coupon bond

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds … Microsoft Outlook Personal Email and Calendar | Microsoft 365 A Microsoft 365 subscription includes premium Outlook features like an ad-free interface, enhanced security, the full desktop version of Office apps, and 1 TB of cloud storage.

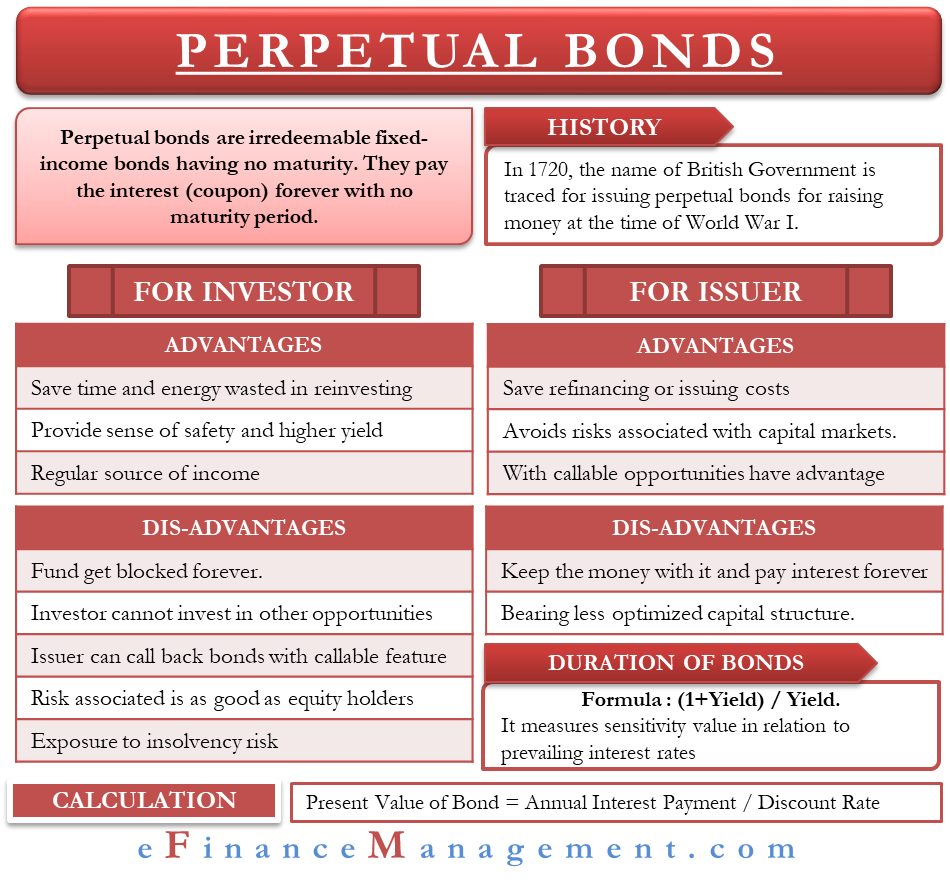

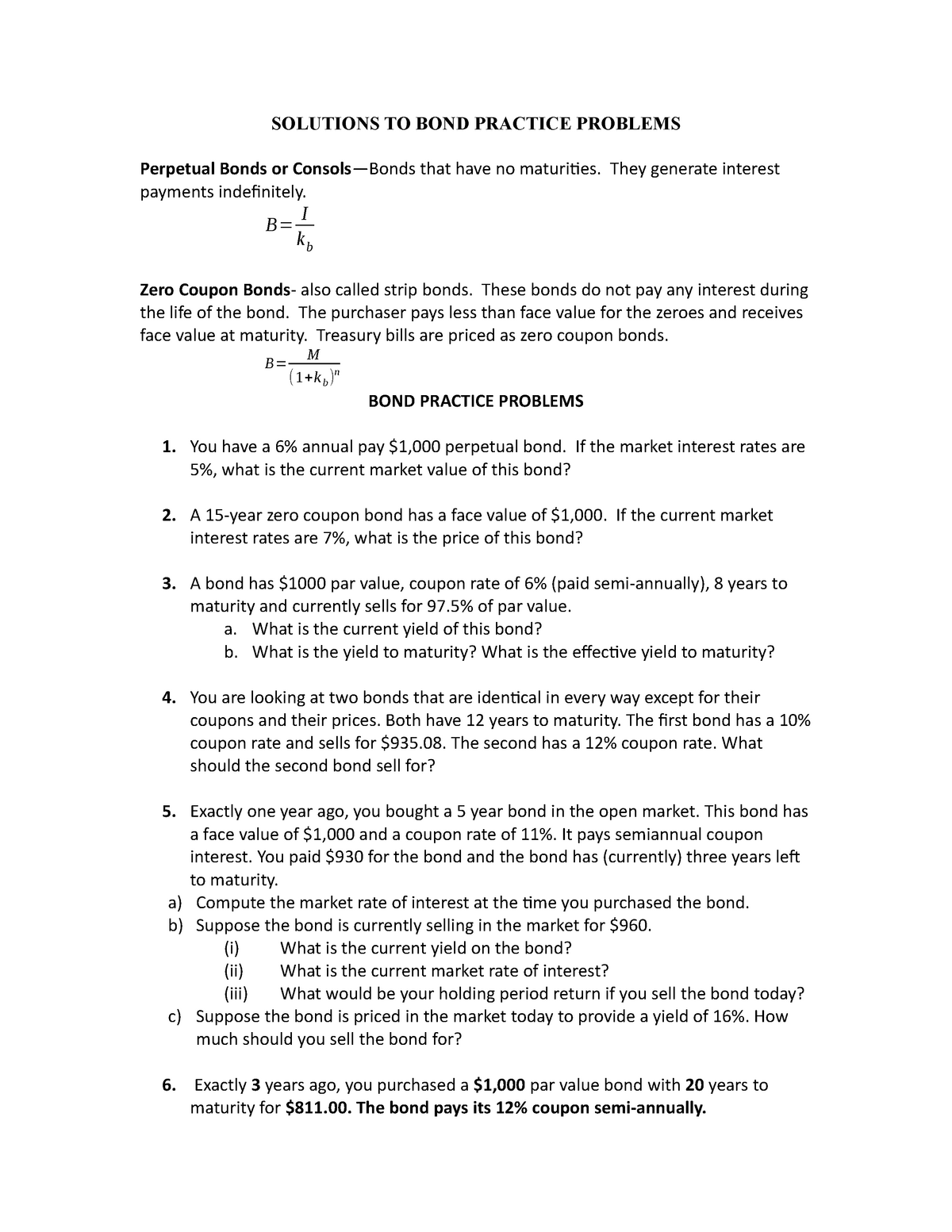

Perpetual zero coupon bond. Perpetual Bond: Definition, Example, Formula To Calculate Value Mar 19, 2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ... Mortgage-backed security - Wikipedia A mortgage-backed security (MBS) is a type of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment bank) that securitizes, or packages, the loans together into a security that investors can buy.Bonds securitizing mortgages are usually … Bond (finance) - Wikipedia Perpetual: no maturity Period. Coupon. The coupon is the interest rate that the issuer pays to the holder. For fixed rate bonds, the coupon is fixed throughout the life of the bond. For floating rate notes, the coupon varies throughout the life of the bond and is based on the movement of a money market reference rate (often LIBOR). Shop by Category | eBay Shop by department, purchase cars, fashion apparel, collectibles, sporting goods, cameras, baby items, and everything else on eBay, the world's online marketplace

Microsoft Outlook Personal Email and Calendar | Microsoft 365 A Microsoft 365 subscription includes premium Outlook features like an ad-free interface, enhanced security, the full desktop version of Office apps, and 1 TB of cloud storage. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds … Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

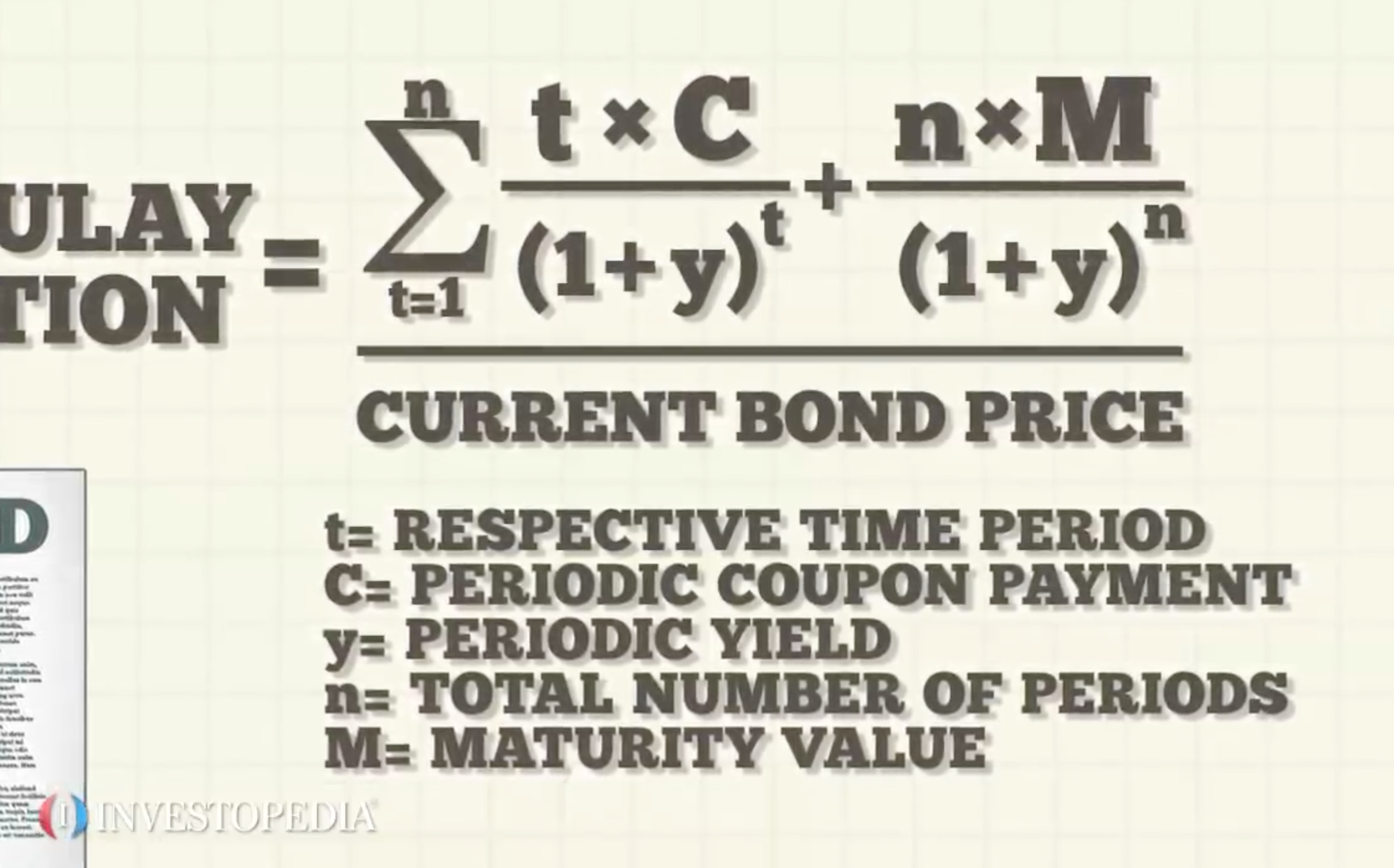

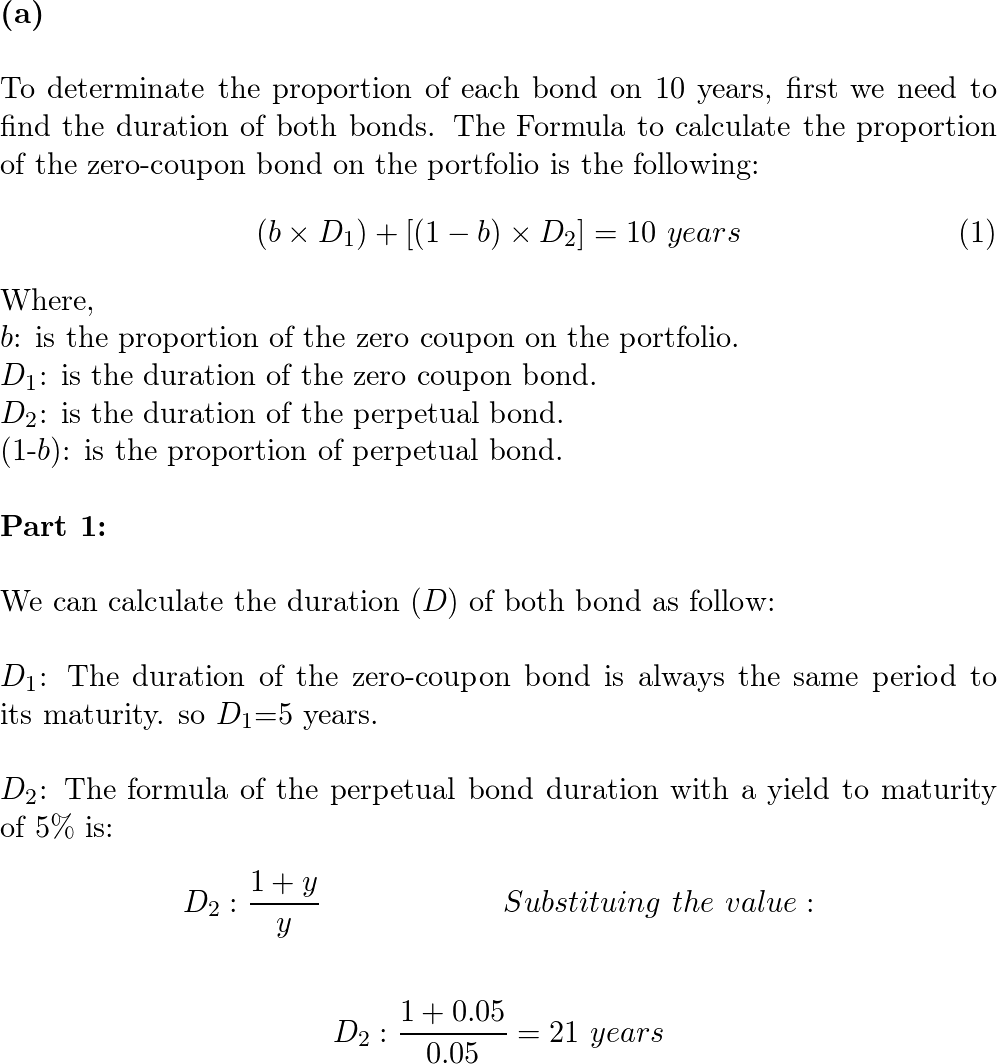

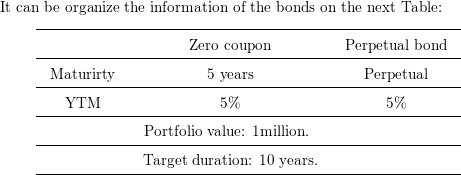

The formula for the duration of a perpetual bond which makes an equal payment each year in perpetuity is (1 + yield)/yield. If bonds yield 5 percent, which has the longer duration—a perpetual bond or ...

Post a Comment for "43 perpetual zero coupon bond"